Managing the Wireless Spend Ryan Larsen is the President of Urban-Technology Group, based in Seattle, and a new consultant member of the STC.

Trends indicate 2009 will bring even greater profits for mobile wireless, an industry that continues to go in a different direction than the overall economy: up. That is, up in revenue, up in subscribers and up in new services and smart phones. The mobile wireless communications industry has become a $143.7 billion industry (up from $18.6 billion in 1995), according to the CTIA, with no end in sight.

Source: Wireless Expense Mobility Optimization Aberdeen Group. In May 2007, Aberdeen Group examined the use of wireless expense management technologies and the experiences and intentions of 221 enterprises in a diverse set of industries. |

While this increase may be great for investors, it may not be so great for organizations that are spending an average of $72 to $124 per month for every mobile wireless phone. Having personally dealt with mobile wireless and particularly mobile wireless invoices for the better part of my career, I keep coming back to the same two conclusions: First, organizations without a proactive strategy that focuses on both how technology will benefit the company and the total cost of ownership of wireless investments will find only limited success in managing these spends. Second, organizations must focus more than ever on cutting costs without compromising either their customers' experience or their employees' productivity. So how should customers navigate through the complexities of these industry practices to cut costs and remain competitive, and how should we deal with the broader array of management challenges that are specific to wireless services? Industry Challenges To understand the ways in which organizations can maximize their wireless technology investment, it is important to first understand three unique challenges: the climate of dynamic change within the wireless industry, interrelationships among providers, and usage-based billing. Dynamic Change First, the mobile wireless industry is still in the midst of evolving while growing at an extremely fast rate. Over the past few years we have seen service providers come under fire by both congress and the FCC. In fact, we have even seen customers filing class action lawsuits to push for changes in billing methods (text messaging), early termination fees, and 3G network coverage, to name a few. Some of these lawsuits have been settled and some are still progress- sing. Although some of these actions are seen as frivolous by the services providers, these legal proceedings are an indication of more changes to come. Changes in a rapidly growing industry can be great for end users, but their consequences are likely to manifest in the form of increased complexity when it comes to managing wireless mobile solutions. Interrelationships Among Providers Service providers in the mobile wireless industry have aligned themselves to take on greater control and profits. Enterprise I.T. typically purchases hardware from any number of manufacturers and resellers, purchases local voice, long distance and Internet services from any of the local and national service providers, and licenses software and applications from various companies worldwide. Conversely, in the mobile wireless industry an organization looking for service in the United States can choose from among four service provider options: AT&T, Verizon Wireless, T-Mobile and Sprint/Nextel. Although there is some overlap among these providers, each offers its own service plans and offerings, each sells hardware configured, and in some cases locked, to work only on their network, and each supplies software operating systems for their hardware — configured in the way they want their customers to use it. Usage-Based Billing A third challenge for organizations is the methodology mobile service providers apply in billing for their services. In addition to telecom service environments where there are "Monthly Recurring Charges" and "Non-recurring Charges," the mobile wireless industry has a couple more charges that they tack on to their bill, including: - Cost per Use (CPU) - Cost per use includes service like text message charges on incoming and outgoing messages, calls using 411- Information, call forwarding, etc.

- Cost for using too much (CFUTM) - This charge can be as high as $0.40 per minute for every minute you go over your determined "bucket" of monthly minutes. This particular charge has the potential to multiply the cost of a monthly invoice and is typically the most difficult to control, especially when you have hundreds of phones.

Identifying Wireless Management Challenges Once an organization determines its need for a mobile wireless solution, it should ask itself whether a "Corporate Liable" solution, a "Consumer Liable" solution, or a blend of both makes more sense. In a Consumer Liable solution, employees own the service and hardware. In a Corporate Liable solution, the corporation is responsible for the hardware and services owned. Each arrangement carries its own pros and cons. This means stakeholder purchasing decisions should reflect the organization's overall goals. For instance, if security is critical to conducting business, a Corporate Liable policy would be essential to meeting that objective. However, if an organization decides that it is important to have employees assume the responsibilities of their individual wireless needs in addition to their monthly bill, then Consumer Liable is likely to represent the best route. Although organizations that choose Corporate Liable will have a greater ability to standardize the offering and regulate use, that standardization carries its own set of challenges, including: How much will the organization spend on each user? Who will provide the ongoing management of the service, hardware and applications? What calling plans will they use? Who makes decisions on who gets what? What hardware and what e-mail solutions does the organization want to standardize upon? On the other hand, there are also several challenges for organizations that utilize Consumer Liable service. First will be a need to oversee and control expenses. Also, organizations should anticipate the potential loss of sensitive information or intellectual property contained on employees' mobile devices. In addition, organizations potentially lose control of a phone number that has been published for use by their customers. Finally, the organization using the Consumer Liable model will be unable to standardize the service provider, hardware, or applications used within the company. Although the idea of employees providing their own mobile wireless service is compelling, organizations must not fail to take into consideration their long-term vision and how they plan to continue integrating mobile wireless services into their business operations to receive a complete return on their investment. Creating a Corporate Strategy and Policy Having a corporate strategy and policy is key to ensuring companies can measure the true cost of ownership and successfully manage their wireless solution. The benefits of creating a corporate strategy and policy include increasing employee productivity and simplifying employees' ability to multi-task and serve their customers, each of which will increase revenue. An organization's policy should carefully outline how services, hardware and applications will be adopted and deployed, including an articulation of policies surrounding statutory use restrictions (e.g., driving while using the phone), tax issues, and security requirements. It should also be widely distributed and enforced. Some areas to address in the policy include: - How will expenses be monitored, controlled and bench-marked as a means for enforcement and cost control?

- What are the expectations of the end users are as it relates to what services are acceptable for use?

- How much use is acceptable and where and when the hardware should and should not be used? What security requirements are needed for control of sensitive corporate data and network access?

Implications For consultants, helping clients put together a mobile wireless strategy is all about bringing together finance and I.T. executives, management, and selecting a group of employees who represent the various users within the organization to identify which employees and what types of hardware, service and applications will benefit the organization to the greatest degree. Documenting and defining this information will help you craft a policy that is crucial to controlling costs, company assets, hardware and phone numbers. Staying Informed With the industry changing often, and new products and billing methods continually being offered, it is important that we continue to stay abreast of the industry's current state and what's to come. The industry continues to add and improve mobile devices and is consistently evolving and adding new software applications. The effect will be new provider service offerings that include faster data network access and innovative methods of enhancing these systems already in place. A few innovative areas of the wireless industry are worth observing: - Google's Android — The long anticipated G1 phone that uses Google's "open source" operating system, Android. The phone is currently being sold by T-Mobile and is manufactured by HTC. code.google.com/android/

- Strata8 Networks — A Seattle-based startup that offers a unique solution to minimize the use of a company's mobile wireless phone minutes from a customer's wireless provider by deploying their own licensed spectrum in a campus environment. www.strata8.com

- LogMeIn — Most commonly known for their remote PC support software, LogMeIn has recently deployed a new solution for I.T. managers to login and take control of an end users mobile wireless phone to provide the user with help on configuration, support or troubleshooting. www.logmein.com

Going Forward ... Now more than ever, organizations and their consultants must analyze these changes and evaluate the ways new services can address their organizational needs. |

By Michael Dinan, TMCnet Editor

By Michael Dinan, TMCnet Editor As reported by

As reported by

By Richard Widows

By Richard Widows

We can see the marketing now: "If you liked square screens, just wait till you see a circular one!" The latest phone to roll out of the Moto fun factory is the Motorola Aura, a fashion phone with a circular display. This may be the actual pinnacle of Motorola's desperation — we can't see how it can get any weirder than this.

We can see the marketing now: "If you liked square screens, just wait till you see a circular one!" The latest phone to roll out of the Moto fun factory is the Motorola Aura, a fashion phone with a circular display. This may be the actual pinnacle of Motorola's desperation — we can't see how it can get any weirder than this.

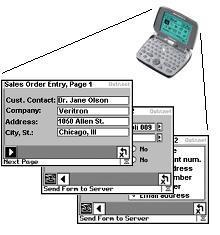

If you see someone in the field (like salespeople, technicians, and delivery people) using paper forms, their company could probably save a pile of money, and get much better timeliness, accuracy and efficiency, by using converting to Outr.Net's Wireless Forms. Custom applications for as little as $995, delivered in just a few days.Outr.Net has a web page on Wireless Forms for Timeports at:

If you see someone in the field (like salespeople, technicians, and delivery people) using paper forms, their company could probably save a pile of money, and get much better timeliness, accuracy and efficiency, by using converting to Outr.Net's Wireless Forms. Custom applications for as little as $995, delivered in just a few days.Outr.Net has a web page on Wireless Forms for Timeports at:  On Monday, October 20, the ARRL filed a Petition for Modification or Cancellation of Experimental Authorization (

On Monday, October 20, the ARRL filed a Petition for Modification or Cancellation of Experimental Authorization (