BloostonLaw Telecom Update Published by the Law Offices of Blooston, Mordkofsky, Dickens, Duffy & Prendergast, LLP [Portions reproduced here with the firm's permission.] www.bloostonlaw.com |

| Vol. 13, No. 48 | December 8, 2010 |

Carriers Must Notify Customers of “Do Not Call” Options By January 1 The FCC requires each wireline and wireless common carrier (including resellers) offering local exchange service to inform subscribers of the opportunity to provide notification to the Federal Trade Commission (FTC) that the subscriber objects to receiving telephone solicitations. The carrier must inform subscribers of (1) their right to give or revoke a notification of their objection to receiving telephone solicitations pursuant to the national “Do Not Call” database; and (2) the methods by which such rights may be exercised. Beginning on January 1, 2004, and annually thereafter, such common carriers shall provide an annual notice, via an insert in the customer’s bill, to inform their subscribers of the opportunity to register or revoke registrations on the national Do Not Call database. BloostonLaw will provide clients with the wording for an appropriate notice upon request. In addition, both wireline and wireless carriers must make a one-time notification, to any person or entity engaged in making telephone solicitations, of the national do-not-call requirements. At a minimum, such notification must include a citation to the relevant do-not-call provisions as set forth in Section 64.1200 of the FCC's rules and Section 310 of the Communications Act. Carriers must make reasonable efforts to comply with this requirement in the case of doubt as to whether a person or entity is in fact engaged in telephone solicitations. Again, BloostonLaw will provide clients with the wording for an appropriate notice upon request. BloostonLaw contacts: Hal Mordkofsky, Ben Dickens, Gerry Duffy, and John Prendergast. |

Rep. Fred Upton (R-Mich.) will become Chairman of the House Energy and Commerce Committee when the new Congress convenes in January.

INSIDE THIS ISSUE - FTC testifies on “Do Not Track” legislation.

- Congress passes bill limiting scope of “Red Flag” rule.

- Copps proposes “Public Value Test” for media.

- FCC reschedules construction permit Auction 91 for April 27; imposes freeze.

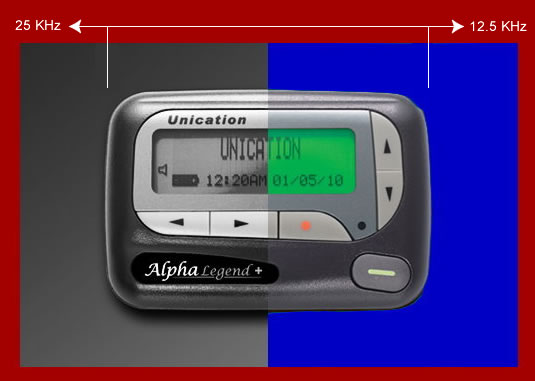

- FCC announces narrowband migration deadlines for 154-174 MHz and 421-512 MHz bands.

|

FTC Testifies On “Do Not Track” Legislation Proposes Browser Setting So Consumers Can Make Choices About Online Tracking The Federal Trade Commission (FTC) last week told Congress that while the Commission recognizes that consumers may benefit in certain ways from the practice of tracking consumers online to serve targeted advertising, the agency supports giving consumers a “Do Not Track” option because the practice is largely invisible to consumers, and they should have a simple, easy way to control it. The FTC proposes that Do Not Track would be a persistent setting on consumers’ Web browsers. At first blush, “Do Not Track” appears to be compatible with the successful “Do Not Call” program (see box on this page). Clients may wish to follow the development of this proposal and offer their support. David Vladeck, Director of the FTC’s Bureau of Consumer Protection, told the House Committee on Energy and Commerce Subcommittee on Commerce, Trade and Consumer Protection that the practice of tracking consumers’ activities online to target advertising, known as behavioral advertising, holds value for consumers because it supports content and services on the Web and delivers more personalized ads. He noted, however, that more transparency and consumer control regarding the practice are needed. The testimony describes the FTC’s efforts to protect consumer privacy for 40 years through law enforcement, education, and policy initiatives. It also provides highlights from the FTC staff’s new report on consumer privacy, and proposes a framework to promote privacy, transparency, business innovation, and consumer choice. The testimony states that while some in the industry have taken steps to improve consumer control of behavioral advertising, industry efforts have largely fallen short. Given the limitations of existing mechanisms, “the Commission supports a more uniform and comprehensive consumer choice mechanism for online behavioral advertising,” sometimes referred to as “Do Not Track.” The most practical way to do that “would likely involve placing a setting similar to a persistent cookie on a consumer’s browser, and conveying that setting to sites that the browser visits, to signal whether or not the consumer wants to be tracked or receive targeted advertisements,” according to the testimony. The testimony states that such a mechanism could be accomplished through legislation or potentially through robust, enforceable self-regulation. “If Congress chooses to enact legislation, the Commission urges Congress to consider several issues,” including: - It should not undermine the benefits online behavioral advertising provides consumers, including funding content and services;

- Unlike the FTC’s Do Not Call Registry for telemarketers, it should not require a registry of unique identifiers; rather, the Commission recommends a browser-based mechanism;

- It should consider an option that lets consumers choose to opt out completely or to choose certain types of advertising they wish to receive or data they are willing to have collected about them;

- The mechanism should be simple, and easy to find and use; and

- The FTC should be given Administrative Procedures Act rulemaking and the ability to fine violators to “provide a strong incentive for companies to comply with any legal requirements, helping to deter future violations.”

The Commission vote approving the testimony and its inclusion in the formal record was 4-1, with Commissioner William E. Kovacic dissenting. BloostonLaw contacts: Hal Mordkofsky, Ben Dickens, Gerry Duffy, and John Prendergast. Congress Passes Bill That Limits Scope Of FTC’s “Red Flag” Rule The U.S. Senate and the House of Representatives recently passed the Red Flag Program Clarification Act of 2010 (S. 3987), which will go on to the White House to be signed into law. The Clarification Act, if ultimately signed into law, would effectively limit the scope of the Federal Trade Commission’s (FTC’s) Red Flag Rule, which is set to begin enforcement on December 31, 2010, by changing the definition of a “creditor” under the Fair and Accurate Credit Transactions Act. (See separate story under “Deadlines” for details on enforcement of Red Flag Rule.) Under the existing Red Flag Rule, most service providers are classified as creditors because clients generally pay for service some time after those services are performed, rather than before. The Clarification Act, proposed by Sen. Mark Begich (D-Alaska), and Sen. John Thune (R-S.D.), would remove many small businesses from the scope of the Red Flag Rule entirely. If signed into law, as expected, the Clarification Act would redefine a creditor as follows: (i) Someone who obtains or uses consumer reports, directly or indirectly, in connection with a credit transaction; (ii) Someone who furnishes information to consumer reporting agencies, as described in section 623, in connection with a credit transaction; or (iii) Someone who advances funds to or on behalf of a person, based on an obligation of the person to repay the funds or repayable from specific property pledged by or on behalf of the person.

This would mean that companies which routinely check potential customers’ credit before opening accounts and providing service would not be exempted. But the Act does not include a creditor that advances funds on behalf of a person for expenses incidental to a service provided by the creditor to that person; and includes any other type of creditor that offers or maintains accounts that are subject to a reasonably foreseeable risk of identity theft. Sen. Begich said, “While this list isn't exclusive, many small businesses such as doctors’ and dentists’ offices, pharmacies, veterinary clinics, accounting offices, and other types of health care providers and other service providers were classified as “creditors'' because they sometimes let clients pay after they provide their services. This legislation makes clear that these small businesses should not be swept under the red flag rule in the future just because they allow payment to be deferred, when they don't offer or maintain accounts that pose a reasonably foreseeable risk of identity theft.” Sen. John Thune said, “Under the legislation that Senator Begich and I are proposing, only a “creditor'' that regularly and in the ordinary course of its business obtains or uses consumer reports in connection with a credit transaction, furnishes information to consumer reporting agencies in connection with a credit transaction, or advances funds would be required to develop and implement a written identity theft prevention and detection program.” Sen. Thune emphasized that, “the legislation makes clear that an advance of funds does not include a creditor's payment in advance for fees, materials, or services that are incidental to the creditor's ability to provide another service that a person initiated or requested, such as the advance payment of expert witness fees by a lawyer to support the representation of a client.” The bill was passed by the Senate on November 30, 2010 and by the House of Representatives on December 7, 2010. BloostonLaw contacts: Ben Dickens, Gerry Duffy, and Mary Sisak. Copps Proposes “Public Value Test” For Media In a speech last week to the Columbia University School of Journalism in New York, FCC Commissioner Michael Copps proposed that the Commission should impose a “Public Value Test” of every broadcast station at relicensing time. This should occur every four years, he said, “in lieu of the slam-dunk, no-questions-asked eight year renewals we dispense 100% of the time now.” Under Copps’ proposal, the FCC’s Public Value Test would include the following: Meaningful Commitments to News and Public Affairs Programming. These would be quantifiable and not involve issues of content interference, according to Copps. Increasing the human and financial resources going into news would be one way to benchmark progress. Producing more local civic affairs programming would be another. The FCC’s current children’s programming requirements—the one remnant of public interest requirements still on the books—helped enhance kids’ programming. Now it is time to put news and information front-and-center. At election time, there should be heightened expectations for debates and issues-oriented programming. Those stations attaining certain benchmarks of progress could qualify for expedited handling of their license renewals. Enhanced Disclosure. Requiring information about what programs a station airs allows viewers to judge whether their local station should be subsidized with free spectrum privileges, Copps said. It opens a window on a station’s performance. He said an enhanced disclosure proceeding has been before the Commission for two years. It may require some minor reworking but there is no reason not to complete this proceeding in the next 90 days. Political Advertising Disclosure. When the accounting is completed, Copps said we will likely find that nearly $3 billion was spent on media advertising in the recent campaign cycle. But he noted that “we have no idea who really paid for this political carpet-bombing.” He said: “The FCC worries, legitimately, about the dangers of placing a bottle of Coke or a tube of toothpaste on an entertainment program without disclosing who paid for the product’s placement. Shouldn't we be even more concerned when unidentified groups with off-the-screen agendas attempt to buy election outcomes? I propose that the FCC quickly determine the extent of its current authority to compel release of what interests are paying for this flood of anonymous political advertising—and if we lack the tools we need to compel disclosure, let’s go ask for them.” Reflecting Diversity. This is not the place for a disquisition on how poorly America’s minorities, women and other diversity groups are faring on our broadcast media, Copps said. “The fact that people of color own only about 3.6% of full-power commercial television stations pretty much documents the shortfall. Diversity goes to how groups are depicted in the media—too often stereotyped and caricatured—and to what roles minorities and women have in owning and managing media companies. The FCC’s Diversity Advisory Committee has spent years providing us with specific, targeted recommendations to correct this injustice. How sad it is that most of these recommendations have not been put to a Commission vote. It is time to right this awful wrong.” Community Discovery. The FCC, back when stations were locally-owned and the license holder walked the town’s streets every day, required licensees to meet occasionally with their viewers and listeners to see if the programs being offered reflected the diverse interests and needs of the community,” Copps said. “Nowadays, when stations are so often owned by mega companies and absentee owners hundreds or even thousands of miles away—frequently by private equity firms totally unschooled in public interest media—we no longer ask licensees to take the public pulse. Diversity of programming suffers, minorities are ignored, and local self-expression becomes the exception. Here’s some good news: Community Discovery would not be difficult to do in this Internet age, when technology can so easily facilitate dialogue.” Local and Independent Programming. The goal here is more localism in our program diet, more local news and information, and a lot less streamed-in homogenization and monotonous nationalized music at the expense of local and regional talent, Copps said. “We should be working toward a solution wherein a certain percentage of prime-time programming—I have suggested 25 percent—is locally or independently-produced,” he said. “Public Service Announcements should also be more localized and more of them aired in prime-time, too. And PEG channels—public, educational and government programming—deserve first-class treatment if we are to have a first class media.” Public Safety. Every station, as a condition of license, must have a detailed, approved plan to go immediately on-air when disaster—nature-made or man-made—strikes, Copps said. “Stations, like government, have a solemn duty to protect the safety of the people. Preferably a station should be always staffed; if there are times when that is not possible, perhaps there are technology tools now that can fill in the gap and make the coverage instantaneous.” BloostonLaw contacts: Hal Mordkofsky, Ben Dickens, Gerry Duffy, and John Prendergast. FCC RESCHEDULES CONSTRUCTION PERMIT AUCTION 91 FOR APRIL 27; IMPOSES FREEZE: The FCC has announced a new start date and pre-auction deadlines for the upcoming auction of certain FM broadcast construction permits and has established the procedures and minimum opening bid amounts for the auction. This auction, which is designated as Auction 91, is now scheduled to start on April 27, 2011. Auction 91 will offer 144 construction permits in the FM broadcast service. The construction permits to be auctioned are for 144 new FM allotments, including 37 construction permits that were offered but not sold in Auction 79. These construction permits are for vacant FM allotments, reflecting FM channels assigned to the FM Table of Allotments. The FCC amended its original Public Notice to remove three construction permits in Tuba City, Ariz.; Union Gap, Wash.; and Ennis City Mont., that were not vacant and have been reserved for other applicant use. Other permits also have been adjusted. The FCC also announced that it will not accept FM commercial and noncommercial educational (NCE) minor change applications during the Auction 91 Form 175 application filing window. This window will open on January 31, 2011, and close on February 10, 2011. The Media Bureau also announces a freeze, effective immediately, on the filing of applications proposing to modify the reference coordinates of any of the 144 vacant non-reserved band FM allotments scheduled for Auction 91, or petitions and counterproposals that propose a change in channel, class, community, or reference coordinates for any of the 144 vacant non-reserved band FM allotments scheduled for Auction 91. Any application, petition or counterproposal that either proposes any change to, or fails to fully protect an Auction 91 FM allotment, or preferred site coordinates specified in an applicant’s Form 175 application, will be dismissed. This freeze will automatically terminate the day after the filing deadline for Auction 91 long form applications. These temporary freezes are designed to avoid conflicts between the frozen filings and auction proposals, and promote a more certain and speedy auction process. An Auction Tutorial is available (via Internet) January 31. Short-form applications (FCC Form 175) filing window opens January 31. Short-form Filing deadline is February 10. Upfront payments are due March 21. Mock Auction is April 25. Auction 91 begins April 27. BloostonLaw contacts: Hal Mordkofsky, John Prendergast, Richard Rubino, and Cary Mitchell. FCC ANNOUNCES NARROWBAND MIGRATION DEADLINES FOR 150-174 MHz and 421-512 MHz BANDS: The FCC has issued a Public Notice to remind interested parties that the deadlines for private land mobile radio services in the 150-174 MHz and 421-512 MHz bands to migrate to narrowband (12.5 kHz or narrower) technology. Licensees and frequency coordinators should be aware of the following deadlines: (1) Beginning January 1, 2011, the Commission will no longer accept applications for: - New wideband 25 kHz (i.e., operating with only one voice path per 25 kHz of spectrum) operations, and

- Modification of existing wideband 25 kHz stations that expand the authorized interference contour (19 dBu VHF, 21 dBu UHF); and

(2) By January 1, 2013, Industrial/Business and Public Safety Radio Pool licensees must: - Operate on 12.5 kHz (11.25 kHz occupied bandwidth) or narrower channels, or

- Employ a technology that achieves the narrowband equivalent of one channel per 12.5 kHz of channel bandwidth for voice and transmission rates of at least 4800 bits per second per 6.25 kHz for data systems operating with bandwidths greater than 12.5 kHz.

Equipment manufacturers should be aware that, beginning January 1, 2011, the Commission will no longer certify 150-174 MHz or 421-512 MHz band equipment capable of operating with only one voice path per 25 kHz of spectrum. Providers may manufacture and import previously-certified equipment with a 25 kHz mode until January 1, 2013. BloostonLaw contacts: Hal Mordkofsky, John Prendergast, and Richard Rubino. FTC SHUTS DOWN CREDIT CARD ROBOCALLERS: At the Federal Trade Commission’s (FTC’s) request, a U.S. district court has approved a settlement shutting down two groups of Florida-based telemarketers that allegedly flooded consumers with misleading pre-recorded robocalls falsely promising to reduce their credit card interest rates. The FTC reached a settlement that permanently bans the two related operations from making robocalls and selling debt relief services. According to the FTC, JPM Accelerated Services and related defendants made thousands of illegal pre-recorded robocalls to consumers, identifying themselves only as “card services” and offering lower credit card interest rates. Consumers who pressed “1" after hearing the automated pitch were transferred to live telemarketers who falsely told consumers that JPM’s services would allow them to dramatically lower their credit card interest rates. The complaint alleged that the telemarketers charged an upfront fee typically ranging from $495 to $995, and promised consumers they would save thousands of dollars in a short period of time as a result of the lower interest rates, and that they would be able to pay off their debts faster. The defendants also falsely stated that if consumers did not save thousands of dollars from lowered interest rates, they would receive a full refund of the upfront fee. After collecting the fee from consumers, however, JPM allegedly failed to deliver the promised interest rate reductions and savings, and routinely refused to honor its money-back guarantee. The FTC complaint also charged the defendants with violating the Telemarketing Sales Rule by calling consumers on the Do Not Call Registry, blocking or “spoofing” caller ID, and making unlawful robocalls. The settlement orders also impose judgments of $5.9 million against defendants associated with JPM, and $3.2 million against six individual defendants associated with an affiliated operation called IXE Accelerated Financial Centers, LLC. The judgments represent the amount of money consumers lost through these robocall schemes. The judgments are suspended, based on the defendants’ inability to pay, but will become due if the defendants are found to have misrepresented their financial condition. Two of the defendants in the IXE operation, Ivan X. Estrella and Jaime Hawley, also are liable for an unsatisfied $75,000 judgment recently entered against them in a case brought by the Florida Attorney General. The Commission vote authorizing the consent orders settling the court action against the individual defendants was 5-0. The orders were filed in the U.S. District Court for Middle District of Florida, Orlando Division on November 9, 2010, against: 1) Ivan X. Estrella, Jamie M. Hawley, and Kimberly Nelson; and 2) Jeanie B. Robertson, Brooke Robertson, Alexander J. Dent, Micha S. Romano, Paul Pietrzak, and Ashley M. Westbrook. Estrella, Hawley, and Nelson worked with the IXE corporate defendants listed below. The rest of the individual defendants worked with the JPM corporate defendants. At the FTC’s request, the court also has dismissed the charges against Paige Dent. The court is reviewing the FTC’s request for a default judgment against the corporate defendants in this case, including the IXE corporate defendants (IXE Accelerated Financial Centers, LLC; and IXE Accelerated Services Inc.), and the JPM corporate defendants (JPM Accelerated Services Inc.; IXE Accelerated Service Centers Inc.; MGA Accelerated Services Inc.; World Class Savings Inc.; Accelerated Savings Inc.; and B&C Financial Group Inc.). The proposed default judgment includes monetary judgments of $3.2 million against the IXE corporations, based in Orlando, Florida, and $5.9 million against the JPM corporations, based in Melbourne, Florida. VERIZON SAYS IT WILL OFFER NO-CONTRACT LTE PLAN OPTIONS: According to press reports, Verizon Wireless says it will offer no-contract Long Term Evolution (LTE) rate plan options in addition to its postpaid LTE pricing. Verizon said the carrier's no-contract LTE service will cost the same as its postpaid offering—the only difference being the cost of the carrier's LTE devices. The carrier will offer 5 GB of LTE data for $50 per month or 10 GB of data for $80 per month; both options will carry a $10 per GB overage charge. Verizon's two USB LTE modems—the LG VL600 and Pantech UML290—will cost $99.99 when subscribers sign a two-year contract. They will cost $250 in a month-to-month scenario. Verizon will launch its commercial LTE service in 38 markets and at more than 60 airports this month. The modems also will work on Verizon's 3G EVDO network. (The pricing plans, however, could change at some point in the future, Verizon said.) According to speed tests of the network conducted by PC Magazine, Verizon's LTE service offered a peak speed of 21 Mbps. At that speed, the publication noted, customers would burn through a 5 GB data allotment in 32 minutes. Verizon has said that its LTE network, even when fully-loaded, will deliver real-world downlink speeds of 5-12 Mbps and uplink speeds of 2-5 Mbps. FCC RELEASES SURVEY ON BROADBAND SATISFACTION: The FCC’s April 2010 survey sought to understand people’s attitudes about their home broadband service. Specifically, the survey explored how people rate certain aspects of their Internet service, from installation and customer service to how understandable they find their bills. The survey found that broadband users report higher levels of satisfaction with the speed and reliability of their service than with the cost of their service. Here are the survey’s main findings related to satisfaction with service: Most Internet users have a very good understanding of the information on their bills regarding how to contact customer service or the price they pay. However, when asked about the clarity of information on their bill about speed, restrictions on service, or fees for terminating service, few users find this information very clear. - 78% of Internet users find information on how to contact the company about a question about the bill or service very clear on their bill, with another 13% finding it somewhat clear.

- 66% of Internet users say their bill is very clear about how much their monthly service charge is, with another 21% finding this information somewhat clear.

- 31% of Internet users say their bills are very clear about whether there are restrictions on their use of Internet service, with another 13% finding it somewhat clear.

- 25% of Internet users say their bill is very clear about how fast their connection speed is, with another 19% saying this information is somewhat clear.

- 17% of Internet users say their bill is very clear about whether they would have to pay fees if they switched service, with 10% finding this somewhat clear.

A majority of broadband users are very satisfied with various dimensions of their service, but nearly one quarter express dissatisfaction with the price they pay. - 59% are very satisfied with the reliability of their service and 33% are somewhat satisfied.

- 51% of broadband users are very satisfied with service overall and 42% are somewhat satisfied.

- 50% of broadband users are very satisfied with the speed of their service and 41% are somewhat satisfied.

- 49% are very satisfied with their broadband provider's customer service and 33% are somewhat satisfied.

- 30% of broadband users are very satisfied with the cost of their service and 44% are somewhat satisfied.

With respect to cost of service, 23% of broadband users expressed dissatisfaction with what they pay per month, with 15% not too satisfied and 8% not at all satisfied.  This newsletter is not intended to provide legal advice. Those interested in more information should contact the firm. |